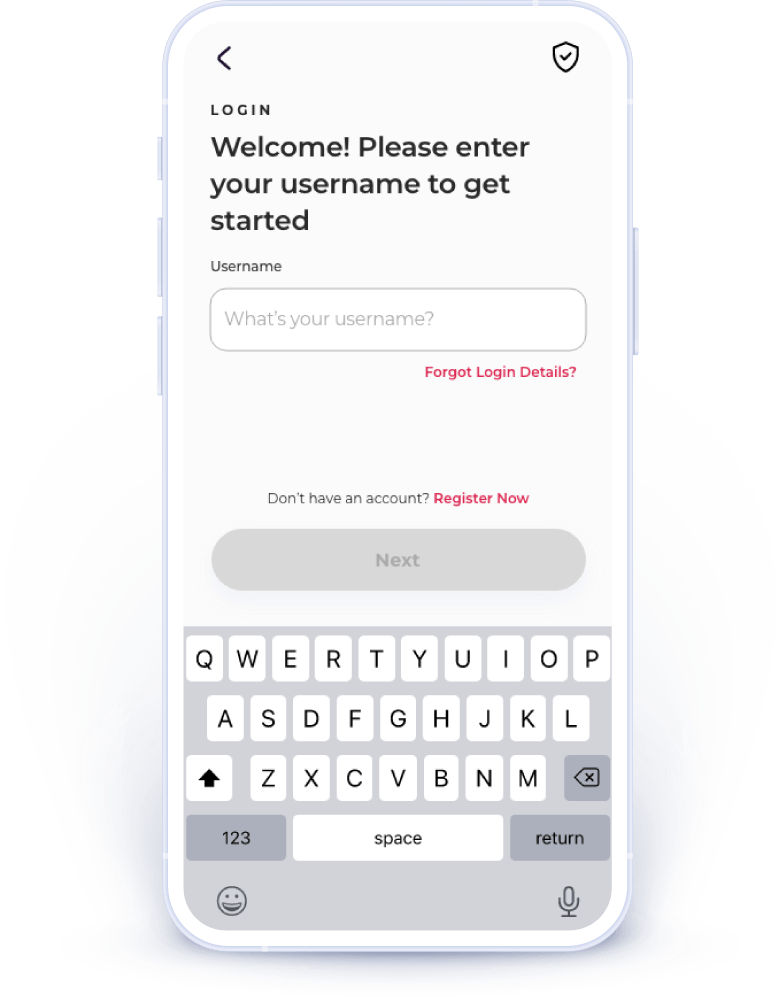

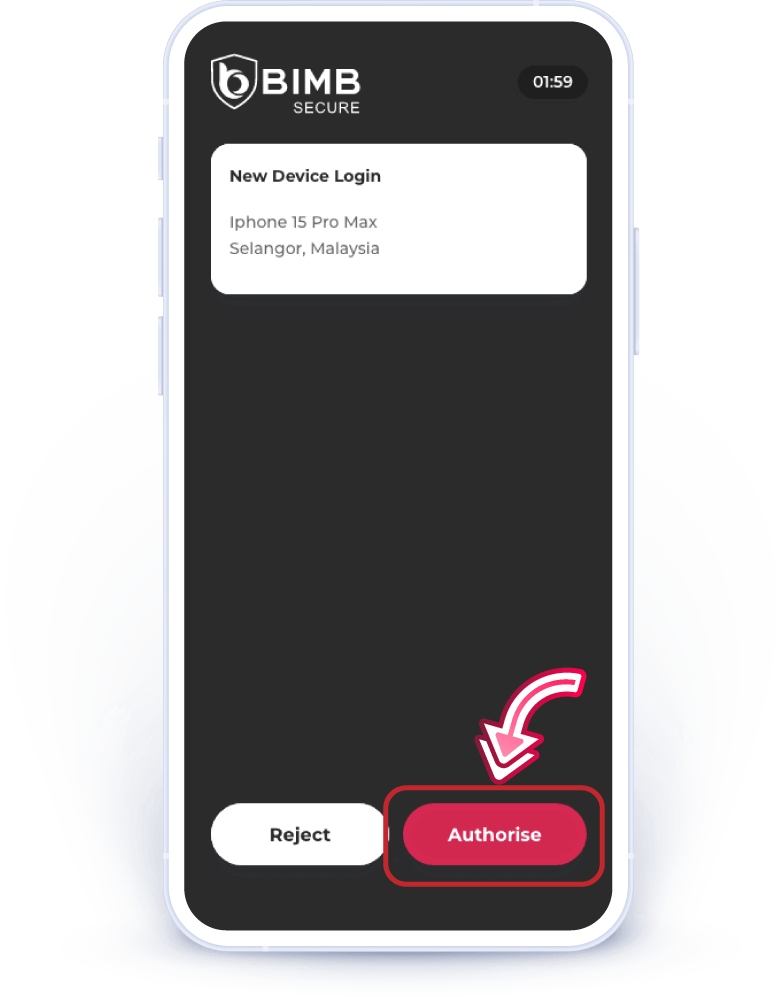

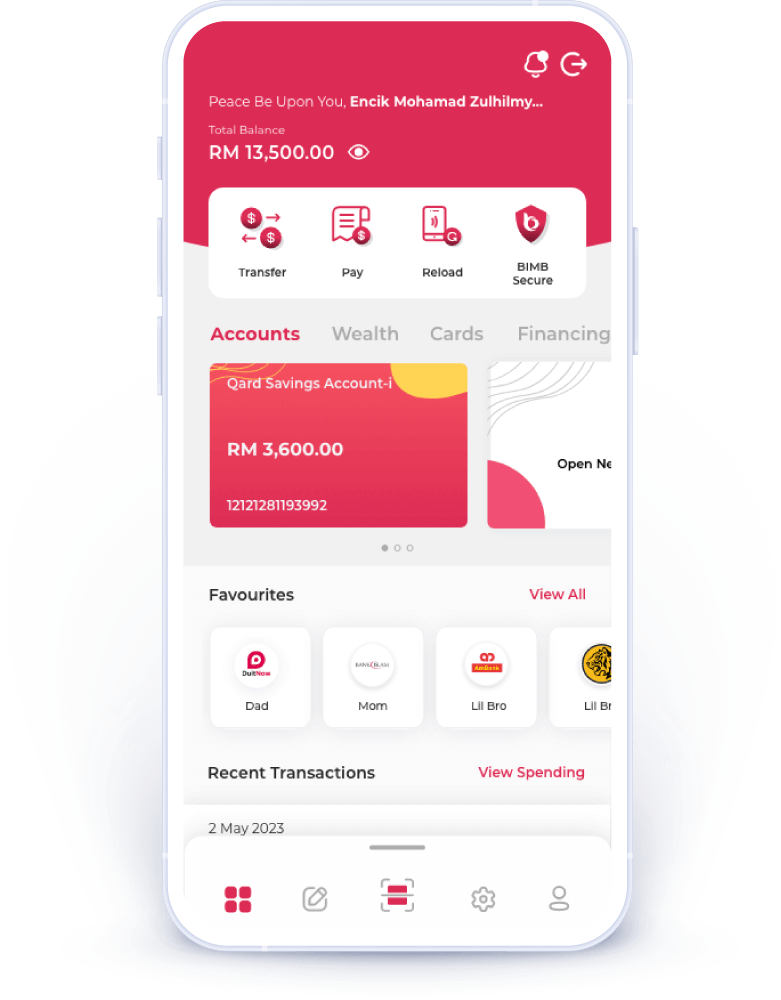

How to login to BIMB Mobile on a new device

A step-by-step guide

What if you can’t complete the binding process?

If you experience issues during the device binding process, follow these steps:

- Visit the nearest branch:

If you don’t receive the approval prompt, you have lost your previous device or are unable to bind your device, please visit the nearest Bank Islam branch. Our staff will verify your identity and help you troubleshoot the issue.

- Ensure you’re using a trusted Device:

Make sure you’re using your own personal smartphone or tablet when accessing Internet Banking. Avoid using public or shared devices to help keep your account secure.

In today’s digital world, keeping your online banking account secure is more important than ever. One of the key security features banks use is device binding. This means your account can only be accessed from one device at a time. If you try to log in from a new device, you’ll need to approve it from your previous device, making sure only you can authorise access to your account on a different device.

Why Is device binding important?

Device binding helps safeguard your internet banking by preventing unauthorized access, especially in cases of phishing, data breaches, or if your login credentials are compromised. Here are the key benefits:

- Enhanced security: Even if someone has your username and password, they won’t be able to access your banking account without passing the device binding verification process.

- Protection against fraud: It reduces the risk of fraudulent activity by ensuring that only trusted devices can access your account.

- Peace of mind: You can feel more confident knowing that your account is protected with an extra layer of security that controls which devices can log in.